2025 Maximum Social Security Tax - What Is The Maximum Social Security Tax 2025 Emalee Alexandra, If you are working, there is a limit on the amount of your earnings that is taxed by social security. Social Security Tax Limit 2025 Withholding Chart Mavra Sibella, The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax.

What Is The Maximum Social Security Tax 2025 Emalee Alexandra, If you are working, there is a limit on the amount of your earnings that is taxed by social security.

Annual Limit For Social Security 2025 Jean Corrianne, The social security tax wage ceiling for 2025 is $168,600 (up from $160,200 for 2025).

Social Security Tax Limit 2025 Withholding Chart Dody Bernardine, Starting with the month you reach full retirement age, you.

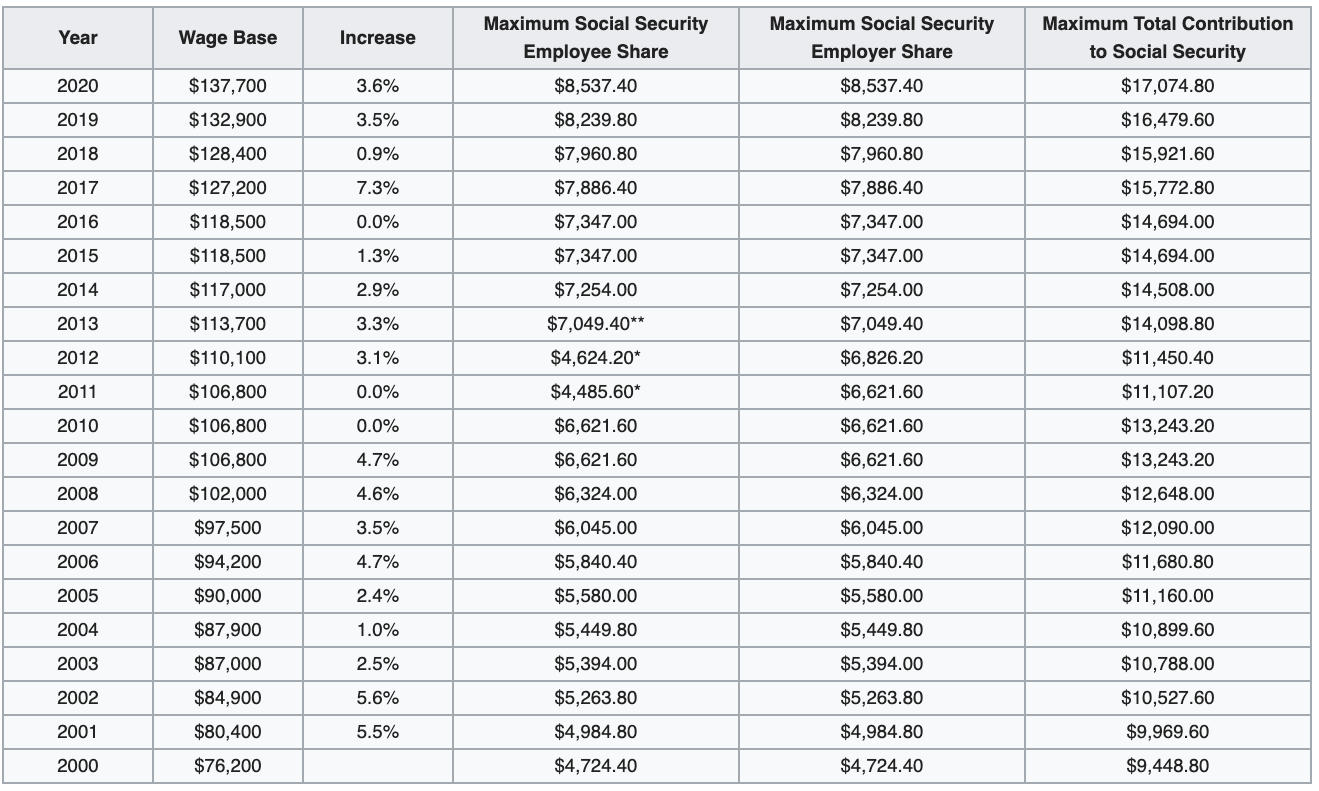

Maximum Social Security Tax 2025 Withholding Tax Lorne Patrice, Workers earning less than this limit pay a 6.2% tax on their earnings.

In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600. The initial benefit amounts shown in the table below assume retirement in january of the stated year, with.

Social Security Max Withholding 2025 Tessa Gerianna, The wage base limit is the maximum wage that's subject to the tax for that year.

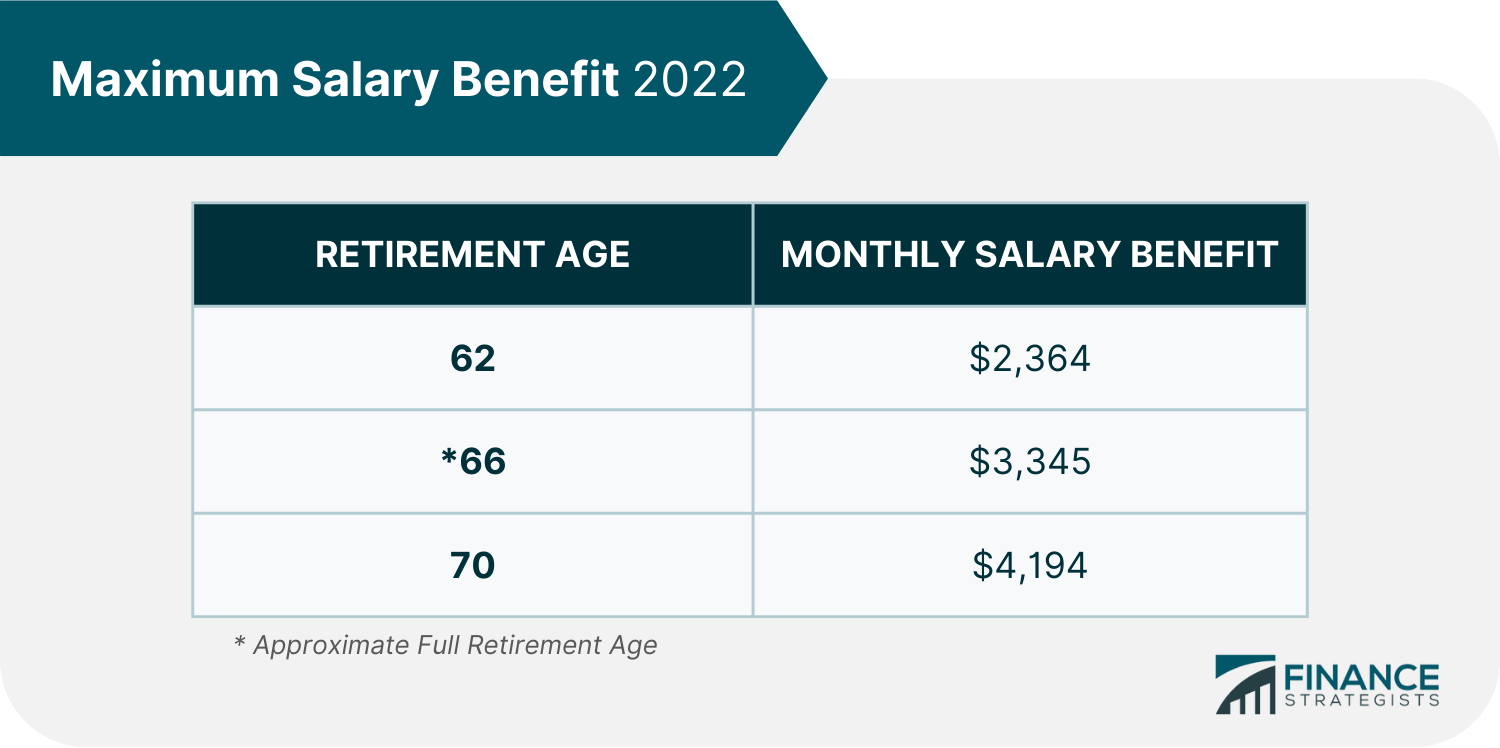

Maximum Social Security Benefit 2025 At 70 Years Old Rose Maurine, It’s $4,873 per month if retiring at 70 and $2,710 for retirement at 62.

What Is Max Social Security Withholding 2025 Hildy Latisha, The maximum social security tax you’ll pay in 2025 is $10,453.20, calculated as 6.2% of the $168,600 wage base limit.

2025 Max Social Security Tax By Year End Caye Maxine, Only the social security tax has a wage base limit.

2025 Maximum Social Security Tax. For employees, the maximum social security tax in 2025 is the product of the tax rate (6.2%) and the maximum taxable earnings ($147,000). The initial benefit amounts shown in the table below assume retirement in january of the stated year, with.

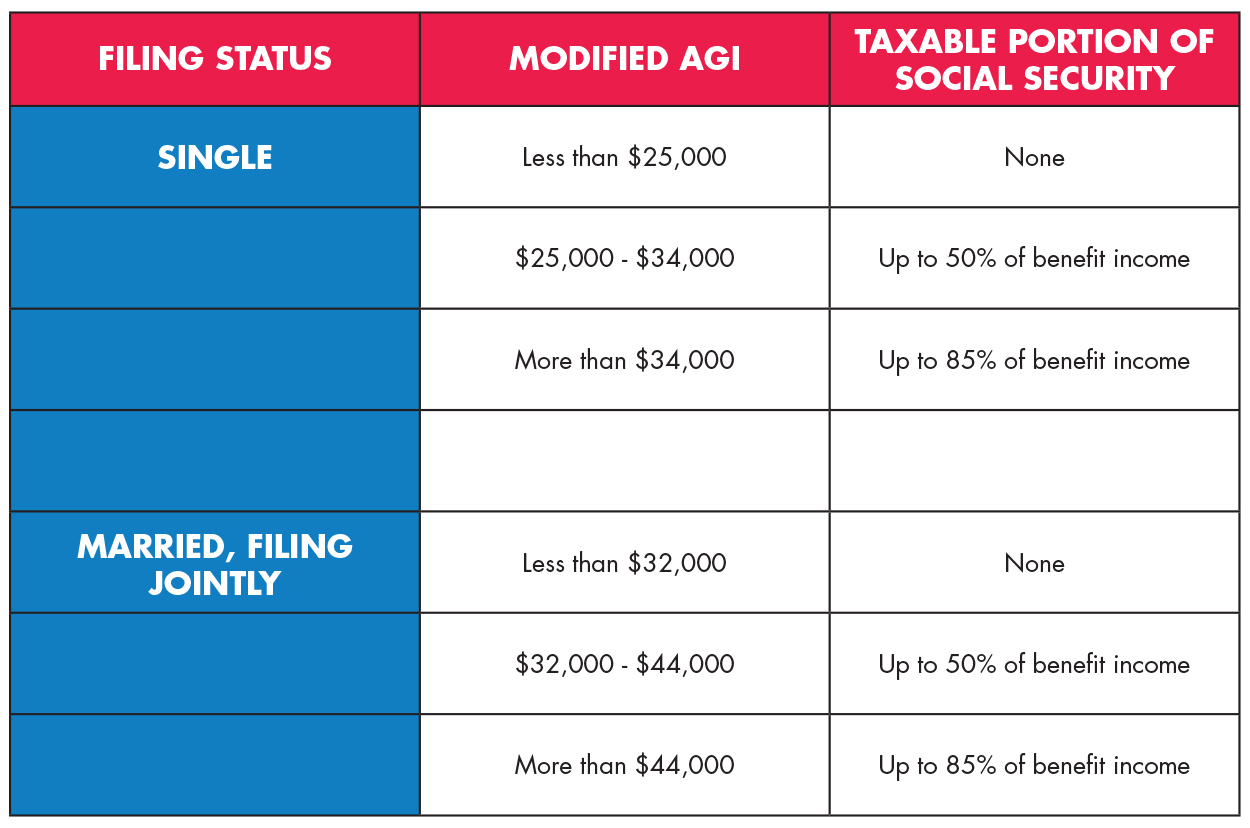

Social Security Benefits Tax Bracket 2025 carlyn madeleine, It’s $4,873 per month if retiring at 70 and $2,710 for retirement at 62.